Click on each tab to view additional details of each

Click on each tab to view additional details of each

Master Files

Vendor files maintain name, address, Federal ID, telephone and account information. Up to nine digits are available to identify vendors.

Data Entry

Data entry functions allow transactions to be entered and can be easily changed, printed or displayed. Data entry activities in Accounts Payable include vouchers

and manual checks. Additional software is available for Purchase Orders which integrates with voucher data entry and financial reporting. Voucher data entry

procedures are integrated with accounts payable check writing.

Features include:

Accounts payable checks may be sorted by vendor name or code with the stub listing all voucher descriptions and amounts. Also, the option to have designated vouchers

print on separate checks is available. Checks may be printed in the following formats: 7” stub-check, 11”stub-check-stub, 11” z-fold self-mailer, and window envelope.

Voucher related Accounts Payable features include:

Additional Special Accounts Payable features include:

Monthly Processing Reports

Timesheet Reports

General Ledger Reports

Cost Allocation Reports

Financial Reports

General Ledger

The GMS Accounting and Financial Management/Reporting System offers a flexible accounting structure designed to respond to virtually all management, audit, Board of Directors, and funding source requirements. From transaction entry to financial statements to detailed account ledgers, the GMS General Ledger provides complete audit trails.

Chart of Accounts

Rather than require a large number of digits to code accounting transactions, our integrated structure streamlines data entry enhancing system performance.

All accounts may be designated as active or inactive. The system does not allow deleting accounts with activity. The GMS chart of accounts is designed based on the needs of each client’s organization.

Program Elements

Program Elements are activities or components within projects or grants. Since the elements are linked to projects when they are created, data entry is simplified. Program Elements are the building blocks for the financial reporting structure. Line item revenue and expenditure reports will be generated at the program element (cost center) level, summed up to the project level, and finally added into agency-wide reports.

6 digit codes are used to describe program elements (cost centers, activities, components, work program activities, etc.)

Reporting

There are several standard reports that result from month-end processing, those reports include:

Cost Allocation

GMS has the most comprehensive Cost Allocation system on the market today! Because of the variety of ways clients handle cost allocation, GMS software accommodates a vast array of choices. During on-site installation and training, many of the issues are sorted out which then provide reports that are most suited to a particular agency’s requirements. Once set-up files are completed, month-end cost allocation functions are just a quick click of the mouse.

Besides the allocation of leave, fringe benefits, and indirect costs that are included in the basic package, there are several cost allocation supplements that are available to meet certain agency allocation and reporting requirements. These include program-specific allocations using either an internal or external year-to-date base, monthly allocations using an external base such as square footage, and a dual indirect pool used for separating common costs from M&G costs. Cost allocation reporting supplements available include the detail of salary, leave, and fringe costs by employee or position code, shifting indirect costs to the administration component, locking allocated amounts, and calculating the line item detail for allocated amounts.

Leave Rate Computation and Analysis

The Leave Rate Computation and Analysis is the first cost allocation step accumulating year-to-date leave charges, computing leave earned costs consistent with organizational personnel policies and calculating rates to allocate leave costs to programs.

If desired, leave costs may be directly charged to programs, however, it will not compute leave earned costs.

This also prints a supporting employee leave balance analysis which details the value of leave balances for each leave balance type. Actual or fixed rates may be used.

Fringe Benefit Analysis and Rate Computation

Year-to-date fringe benefit rates are automatically calculated consistent with your organizations’ fringe benefit policies. If desired, fringe benefits may be directly charged to

programs.

Actual or fixed rates may be used.

Indirect Cost Rate Computation

GMS offers the allocation of indirect or common costs. The Indirect Cost Rate Computation and Analysis may be used to accumulate indirect cost transactions, compute a year-to-date indirect cost rate and automatically apply indirect costs to programs.

Actual or fixed rates may be used.

Budget Preparations

There are five types of budgets maintained in the GMS system.

Program Budgets

These budgets appear on the element and project revenue and expenditure reports. They are to be entered for the entire grant or contract period and will be compared with project to date amounts.

Indirect Cost Budget

This budget is entered for each indirect cost pool (elements 999000-999900).Indirect cost budgets are compared to fiscal year-to-date amounts charged in the indirect cost pools.

Fringe Benefit Budget

This budget is used to monitor charges to the Fringe Benefit Pool. The fringe benefit budget is compared to fiscal year-to-date charges in the Fringe Benefit Pool (Element 998000).

YTD Timesheet Budgets

Timesheet budgets are expressed in hours and appear on Year-to-date Timesheet Charges by Employee and by Activity reports where they are compared to fiscal year-to-date

hours charged on time sheets. This is a great management tool!

Agencywide Budget

This budget appears on the Agencywide Line Item Revenue and Expenditure report. You enter this budget for the agency’s fiscal year. On financial reports they are compared to fiscal year-to-date revenues and expenses.

You may enter, change, print, display or export all types of budgets.

Document attachment is available at the batch or individual document level. Once a document is attached a paperclip image will appear on the bottom of the form. Should you wish to view a document already attached, click on the paper clip. If there is only one document attached, when you click on the paper clip the document will open. If there are multiple documents attached the view document form will appear and you may choose which document you wish to view.

GMS Payroll Processing includes payroll functions and reports beginning with the automatic calculation of current period employee gross-to-net payroll through year-end W2 activities. GMS Payroll is timesheet generated. Payroll, labor distribution, leave cost accounting, and leave balance maintenance all result from timesheet data entry procedures.

Sample Payroll Reports

Download File

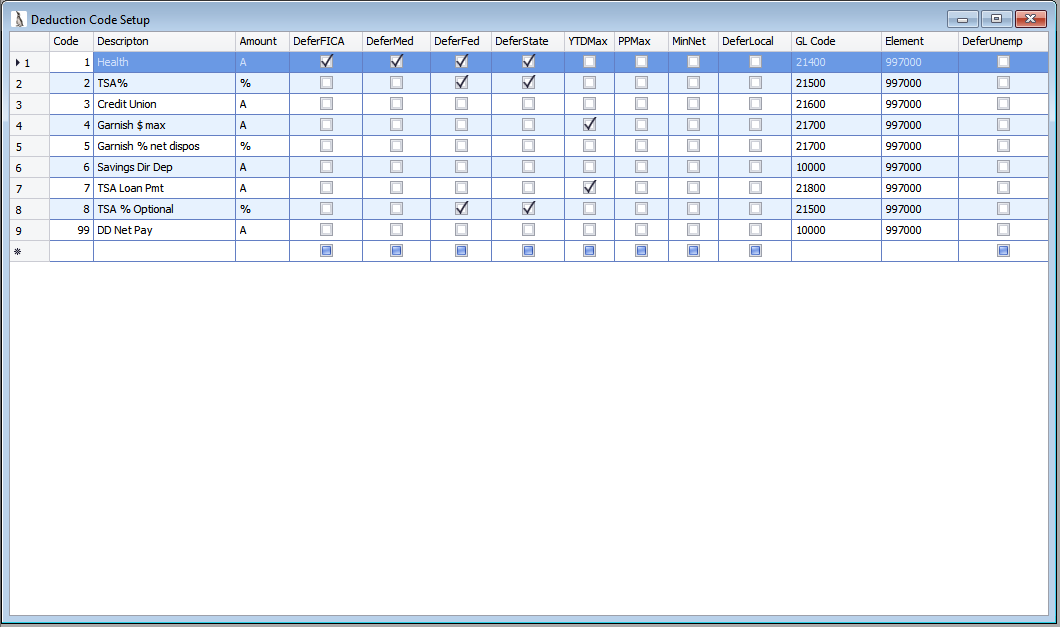

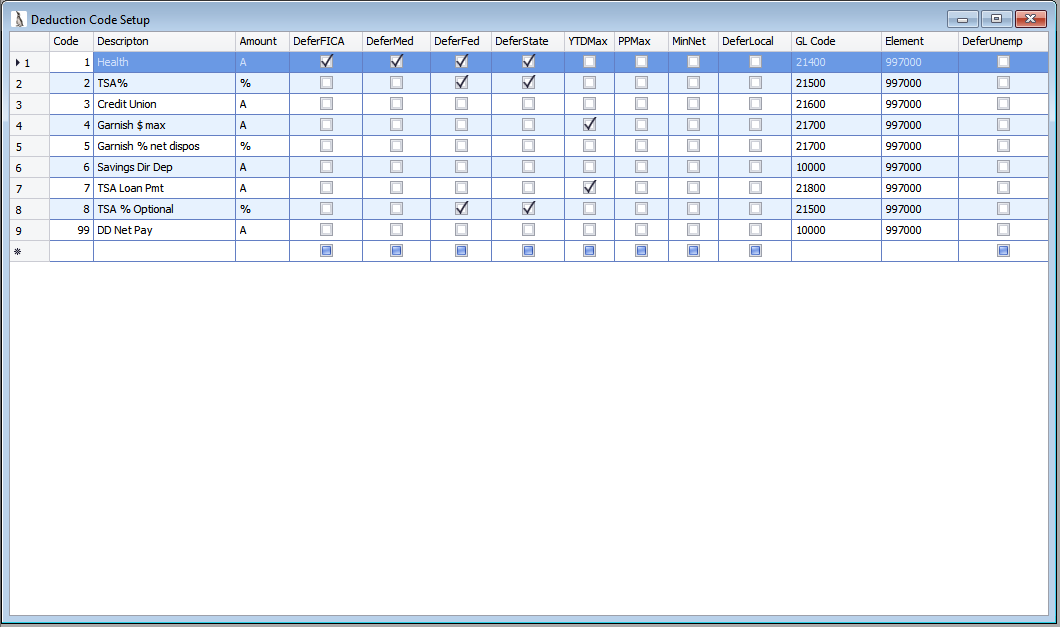

Personnel Setup

The user may set up codes for Deductions, Personnel, Sites, Local Tax, Special Pay, Departments, Positions, Workers Compensation, State-Tax, Pay Codes, Leave Type,

Garnishment Deductions and Multiple Pay Rates with a few easy keystrokes.

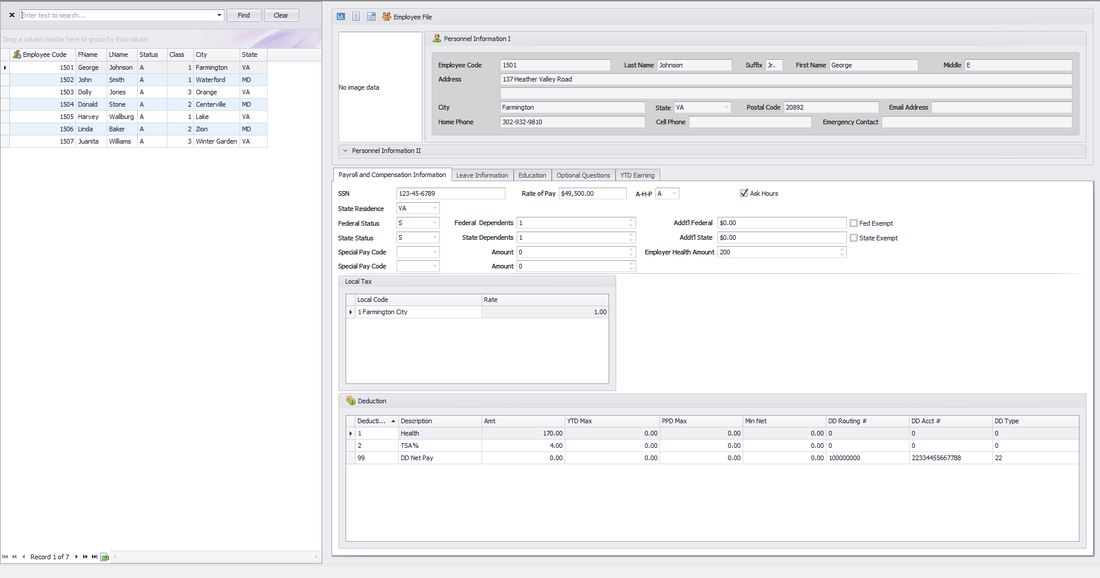

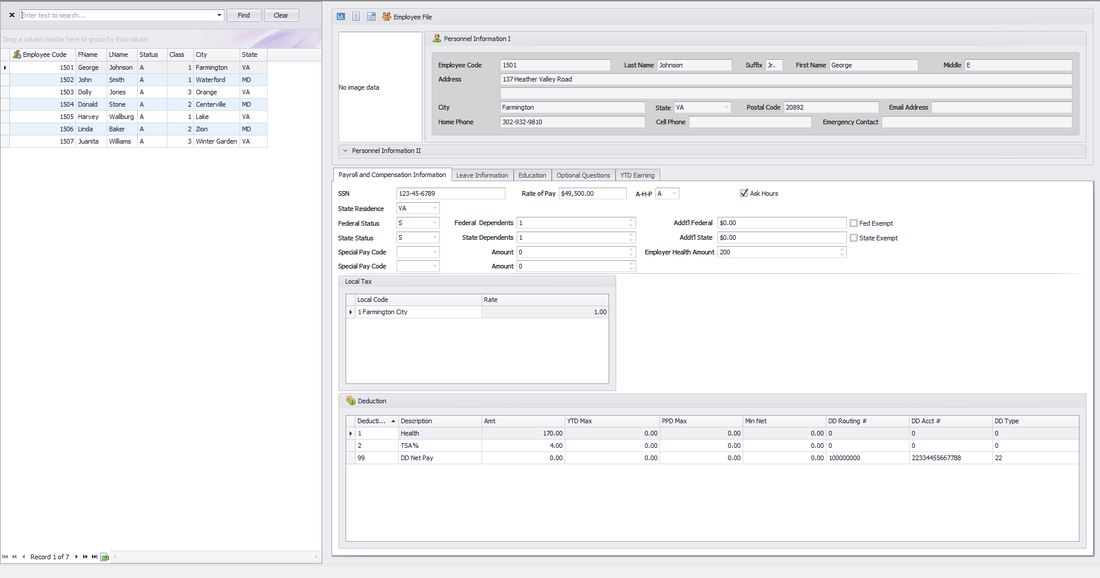

Employee Entry

Employee entry functions allow data to be entered and can be easily changed, printed, and displayed.

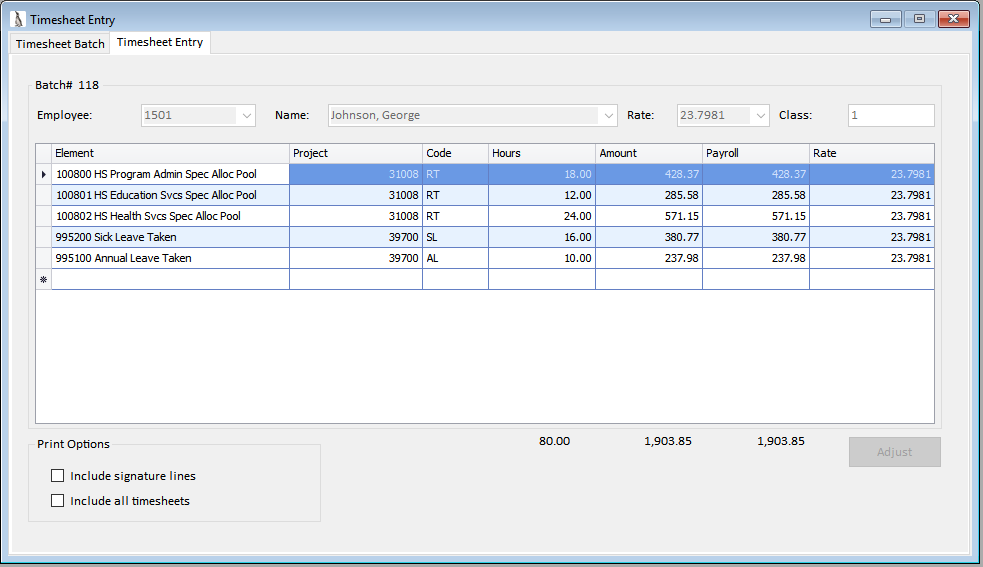

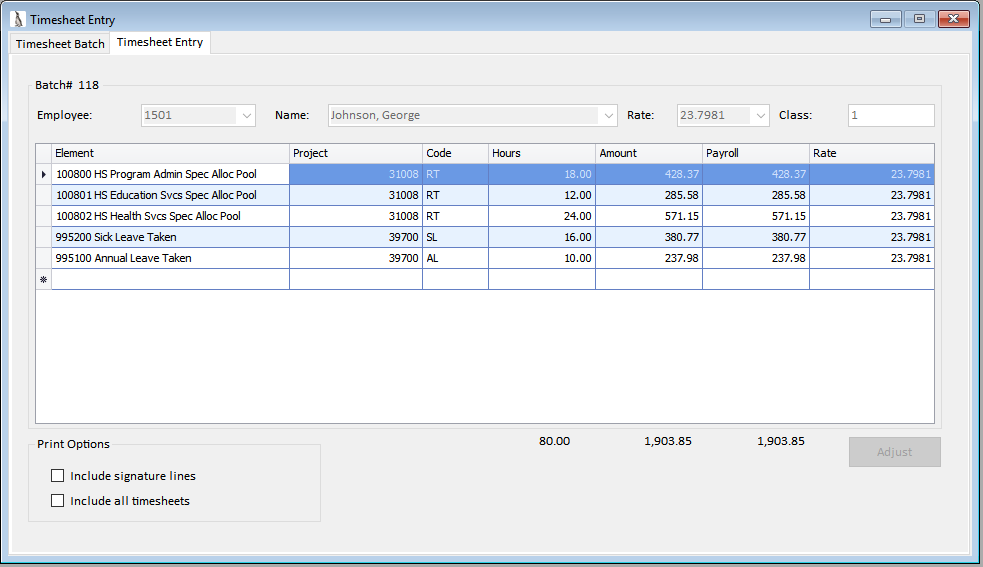

Timesheet Entry

Data entered from an employee’s timesheet is used to create payroll and to maintain employee leave balances.

Each entry will be charged to a program element (activity) within a project or grant listing the number of hours an employee has worked on each task.

This timesheet data will produce a variety of labor distribution reports and post salaries to programs and activities.

Alerts are given during timesheet entry if leave taken exceeds leave balances.

Normal Payroll Activities Include:

Quarterly and Year-End processing includes:

Special GMS features include:

Cash Receipts

The GMS Cash Receipts program allows the user to code the revenue directly to the grant or project for which it was intended. All cash receipt entries have to be in balance to be posted as with all other original books of entry in the GMS system. Cash receipts may be edited to correct any errors that may have occurred.

General Journal

All journal entries have to be in balance to be posted as with all other original books of entry in the GMS system. In all books of entry, prior to printing financial reports, you can unpost batches to edit errors that were made. Recurring journal entries can be created with optional software.

Document Attachment

Document attachment is available at the batch or individual document level. Once a document is attached a paperclip image will appear on the bottom of the form. Should you wish to view a document already attached, click on the paper clip. If there is only one document attached, when you click on the paper clip the document will open. If there are multiple documents attached the view document form will appear and you may choose which document you wish to view.

GMS General Ledger and Financial Reporting System

Does your agency need a general ledger package for cash receipts, general journal, budgeting, and month-end reporting, but not necessarily other components of an accounting system?

GMS now offers the GMS General Ledger and Financial Reporting System, a cut-down version of the GMS Accounting and Financial Management/Reporting System. This system includes the Chart of Accounts, Cash Receipts, General Journal, Month-End Reporting, Budgeting, and Prior Year Maintenance.

It is designed for organizations that run the Revolving Loan Servicing System within their agency and do not necessarily require the use of Accounts Payable, Payroll, Cost Allocation, etc.

Data entry functions allow transactions to be entered with a minimum number of keystrokes and can be easily changed, displayed, printed, or exported. Transactions can be easily stored in batches for efficient proofing and control before posting. Data entry activities include Cash Receipts and General Journal.

General Ledger Codes

Rather than require a large number of digits to code accounting transactions, our integrated structure streamlines data entry, enhancing system performance.

Program Elements

Program Elements are activities or components within projects or grants. Since they are pre-linked to projects when they are created, data entry is simplified.

Program Elements are the building blocks for the financial reporting structure. Line item revenue and expenditure reports will be generated at the program element (cost centers) level, summed up to the project level, and finally added into agency-wide reports.

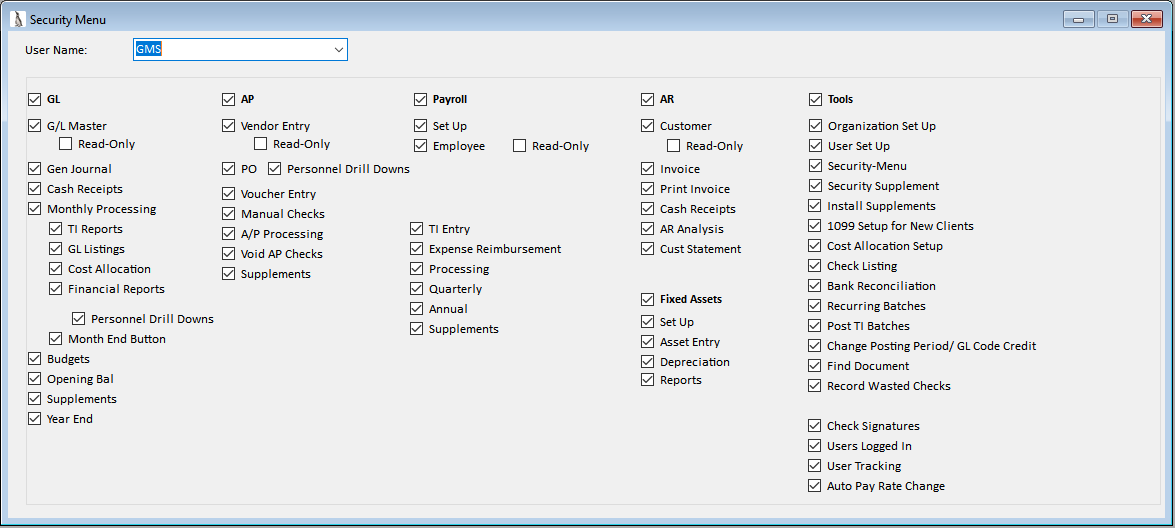

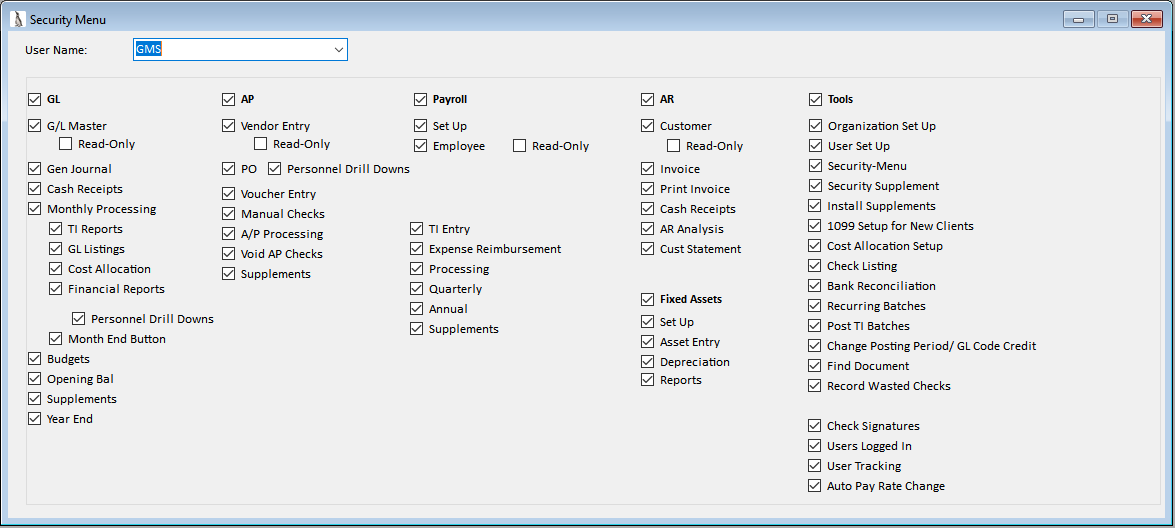

With this feature, you may assign levels of security to each user, or group of users, based on the menu options available. For instance, you may have a program manager that you want to be able to look at budgets and reports but is not able to do any data entry or change the reports in any way. By checking the appropriate boxes within the security menu you will be able to give user(s) rights to those menu items they require access to. You can also assign read-only rights to GL master, employee, vendor, and customer files when applicable. The financial manager and other finance personnel will probably have most all the boxes checked on this menu as they will be doing the day-to-day data entry and reporting. A check in the box means that item is accessible. A blank box means access to that item will be denied.

Master Files

Vendor files maintain name, address, Federal ID, telephone and account information. Up to nine digits are available to identify vendors.

Data Entry

Data entry functions allow transactions to be entered and can be easily changed, printed or displayed. Data entry activities in Accounts Payable include vouchers

and manual checks. Additional software is available for Purchase Orders which integrates with voucher data entry and financial reporting. Voucher data entry

procedures are integrated with accounts payable check writing.

Features include:

Accounts payable checks may be sorted by vendor name or code with the stub listing all voucher descriptions and amounts. Also, the option to have designated vouchers

print on separate checks is available. Checks may be printed in the following formats: 7” stub-check, 11”stub-check-stub, 11” z-fold self-mailer, and window envelope.

Voucher related Accounts Payable features include:

Additional Special Accounts Payable features include:

Monthly Processing Reports

Timesheet Reports

General Ledger Reports

Cost Allocation Reports

Financial Reports

General Ledger

The GMS Accounting and Financial Management/Reporting System offers a flexible accounting structure designed to respond to virtually all management, audit, Board of Directors, and funding source requirements. From transaction entry to financial statements to detailed account ledgers, the GMS General Ledger provides complete audit trails.

Chart of Accounts

Rather than require a large number of digits to code accounting transactions, our integrated structure streamlines data entry enhancing system performance.

All accounts may be designated as active or inactive. The system does not allow deleting accounts with activity. The GMS chart of accounts is designed based on the needs of each client’s organization.

Program Elements

Program Elements are activities or components within projects or grants. Since the elements are linked to projects when they are created, data entry is simplified. Program Elements are the building blocks for the financial reporting structure. Line item revenue and expenditure reports will be generated at the program element (cost center) level, summed up to the project level, and finally added into agency-wide reports.

6 digit codes are used to describe program elements (cost centers, activities, components, work program activities, etc.)

Reporting

There are several standard reports that result from month-end processing, those reports include:

Cost Allocation

GMS has the most comprehensive Cost Allocation system on the market today! Because of the variety of ways clients handle cost allocation, GMS software accommodates a vast array of choices. During on-site installation and training, many of the issues are sorted out which then provide reports that are most suited to a particular agency’s requirements. Once set-up files are completed, month-end cost allocation functions are just a quick click of the mouse.

Besides the allocation of leave, fringe benefits, and indirect costs that are included in the basic package, there are several cost allocation supplements that are available to meet certain agency allocation and reporting requirements. These include program-specific allocations using either an internal or external year-to-date base, monthly allocations using an external base such as square footage, and a dual indirect pool used for separating common costs from M&G costs. Cost allocation reporting supplements available include the detail of salary, leave, and fringe costs by employee or position code, shifting indirect costs to the administration component, locking allocated amounts, and calculating the line item detail for allocated amounts.

Leave Rate Computation and Analysis

The Leave Rate Computation and Analysis is the first cost allocation step accumulating year-to-date leave charges, computing leave earned costs consistent with organizational personnel policies and calculating rates to allocate leave costs to programs.

If desired, leave costs may be directly charged to programs, however, it will not compute leave earned costs.

This also prints a supporting employee leave balance analysis which details the value of leave balances for each leave balance type. Actual or fixed rates may be used.

Fringe Benefit Analysis and Rate Computation

Year-to-date fringe benefit rates are automatically calculated consistent with your organizations’ fringe benefit policies. If desired, fringe benefits may be directly charged to

programs.

Actual or fixed rates may be used.

Indirect Cost Rate Computation

GMS offers the allocation of indirect or common costs. The Indirect Cost Rate Computation and Analysis may be used to accumulate indirect cost transactions, compute a year-to-date indirect cost rate and automatically apply indirect costs to programs.

Actual or fixed rates may be used.

Budget Preparations

There are five types of budgets maintained in the GMS system.

Program Budgets

These budgets appear on the element and project revenue and expenditure reports. They are to be entered for the entire grant or contract period and will be compared with project to date amounts.

Indirect Cost Budget

This budget is entered for each indirect cost pool (elements 999000-999900).Indirect cost budgets are compared to fiscal year-to-date amounts charged in the indirect cost pools.

Fringe Benefit Budget

This budget is used to monitor charges to the Fringe Benefit Pool. The fringe benefit budget is compared to fiscal year-to-date charges in the Fringe Benefit Pool (Element 998000).

YTD Timesheet Budgets

Timesheet budgets are expressed in hours and appear on Year-to-date Timesheet Charges by Employee and by Activity reports where they are compared to fiscal year-to-date

hours charged on time sheets. This is a great management tool!

Agencywide Budget

This budget appears on the Agencywide Line Item Revenue and Expenditure report. You enter this budget for the agency’s fiscal year. On financial reports they are compared to fiscal year-to-date revenues and expenses.

You may enter, change, print, display or export all types of budgets.

Document attachment is available at the batch or individual document level. Once a document is attached a paperclip image will appear on the bottom of the form. Should you wish to view a document already attached, click on the paper clip. If there is only one document attached, when you click on the paper clip the document will open. If there are multiple documents attached the view document form will appear and you may choose which document you wish to view.

GMS Payroll Processing includes payroll functions and reports beginning with the automatic calculation of current period employee gross-to-net payroll through year-end W2 activities. GMS Payroll is timesheet generated. Payroll, labor distribution, leave cost accounting, and leave balance maintenance all result from timesheet data entry procedures.

Sample Payroll Reports

Download File

Personnel Setup

The user may set up codes for Deductions, Personnel, Sites, Local Tax, Special Pay, Departments, Positions, Workers Compensation, State-Tax, Pay Codes, Leave Type,

Garnishment Deductions and Multiple Pay Rates with a few easy keystrokes.

Employee Entry

Employee entry functions allow data to be entered and can be easily changed, printed, and displayed.

Timesheet Entry

Data entered from an employee’s timesheet is used to create payroll and to maintain employee leave balances.

Each entry will be charged to a program element (activity) within a project or grant listing the number of hours an employee has worked on each task.

This timesheet data will produce a variety of labor distribution reports and post salaries to programs and activities.

Alerts are given during timesheet entry if leave taken exceeds leave balances.

Normal Payroll Activities Include:

Quarterly and Year-End processing includes:

Special GMS features include:

Cash Receipts

The GMS Cash Receipts program allows the user to code the revenue directly to the grant or project for which it was intended. All cash receipt entries have to be in balance to be posted as with all other original books of entry in the GMS system. Cash receipts may be edited to correct any errors that may have occurred.

General Journal

All journal entries have to be in balance to be posted as with all other original books of entry in the GMS system. In all books of entry, prior to printing financial reports, you can unpost batches to edit errors that were made. Recurring journal entries can be created with optional software.

Document Attachment

Document attachment is available at the batch or individual document level. Once a document is attached a paperclip image will appear on the bottom of the form. Should you wish to view a document already attached, click on the paper clip. If there is only one document attached, when you click on the paper clip the document will open. If there are multiple documents attached the view document form will appear and you may choose which document you wish to view.

GMS General Ledger and Financial Reporting System

Does your agency need a general ledger package for cash receipts, general journal, budgeting, and month-end reporting, but not necessarily other components of an accounting system?

GMS now offers the GMS General Ledger and Financial Reporting System, a cut-down version of the GMS Accounting and Financial Management/Reporting System. This system includes the Chart of Accounts, Cash Receipts, General Journal, Month-End Reporting, Budgeting, and Prior Year Maintenance.

It is designed for organizations that run the Revolving Loan Servicing System within their agency and do not necessarily require the use of Accounts Payable, Payroll, Cost Allocation, etc.

Data entry functions allow transactions to be entered with a minimum number of keystrokes and can be easily changed, displayed, printed, or exported. Transactions can be easily stored in batches for efficient proofing and control before posting. Data entry activities include Cash Receipts and General Journal.

General Ledger Codes

Rather than require a large number of digits to code accounting transactions, our integrated structure streamlines data entry, enhancing system performance.

Program Elements

Program Elements are activities or components within projects or grants. Since they are pre-linked to projects when they are created, data entry is simplified.

Program Elements are the building blocks for the financial reporting structure. Line item revenue and expenditure reports will be generated at the program element (cost centers) level, summed up to the project level, and finally added into agency-wide reports.

With this feature, you may assign levels of security to each user, or group of users, based on the menu options available. For instance, you may have a program manager that you want to be able to look at budgets and reports but is not able to do any data entry or change the reports in any way. By checking the appropriate boxes within the security menu you will be able to give user(s) rights to those menu items they require access to. You can also assign read-only rights to GL master, employee, vendor, and customer files when applicable. The financial manager and other finance personnel will probably have most all the boxes checked on this menu as they will be doing the day-to-day data entry and reporting. A check in the box means that item is accessible. A blank box means access to that item will be denied.